Tax Schedule Reports:

For Tax Worksheet and Tax Category video tutorials, click here

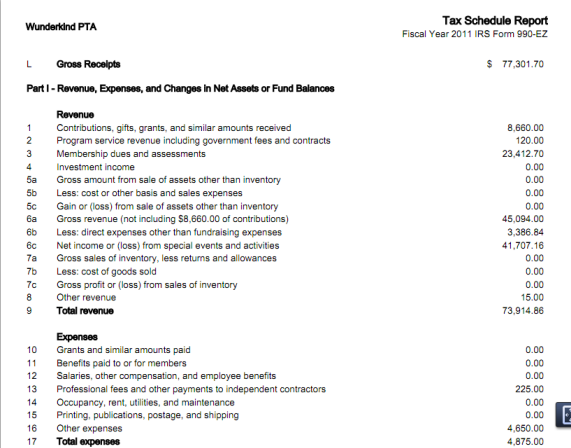

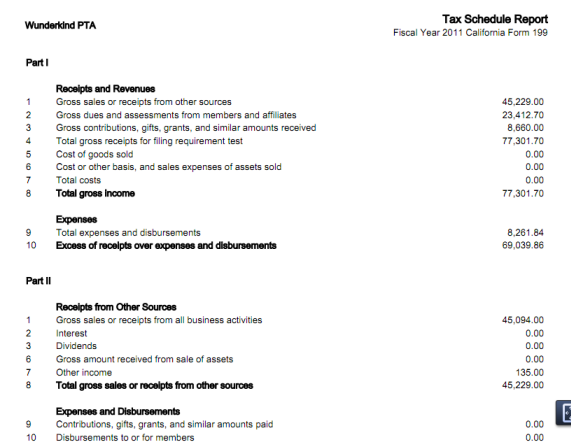

The tax schedule reports are available for both IRS Form 990-EZ and the California Form 199

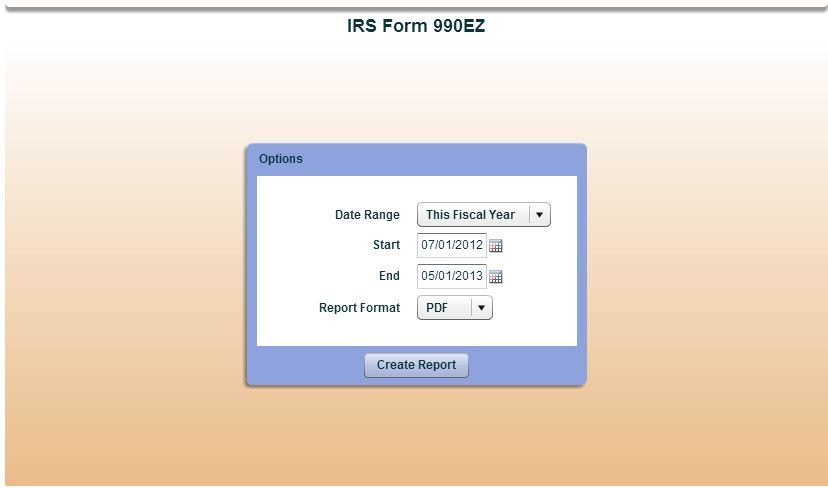

1. Select Reports/Tax Worksheets from the Reports menu

2. Choose either "IRS Form 990-EZ" or "California Form 199" from pop out menu

3. Select the date range from the drop down menu, or manually enter in the dates

4. Choose a report format and select "Create Report"

Note: When generating a Tax Worksheets (CA 199 or 990EZ/990), you may see upon your first attempt to generate the report that it states "Uncategorized Totals - Worksheet is Out of Balance."

What this means is that the categories identified may have one of two issues:

1) For Membership Receipts/Disbursements (Pass-Through), your receipts don't equal your disbursements, or better yet, you have not completed the transaction (written the check) to pass the money through. If that has been accomplished, also ensure you date the for the transaction is appropriate for the receipts (matches the same tax year). These are non-unit funds, and a miss match will prompt you to complete the transaction to remove them from your unit.

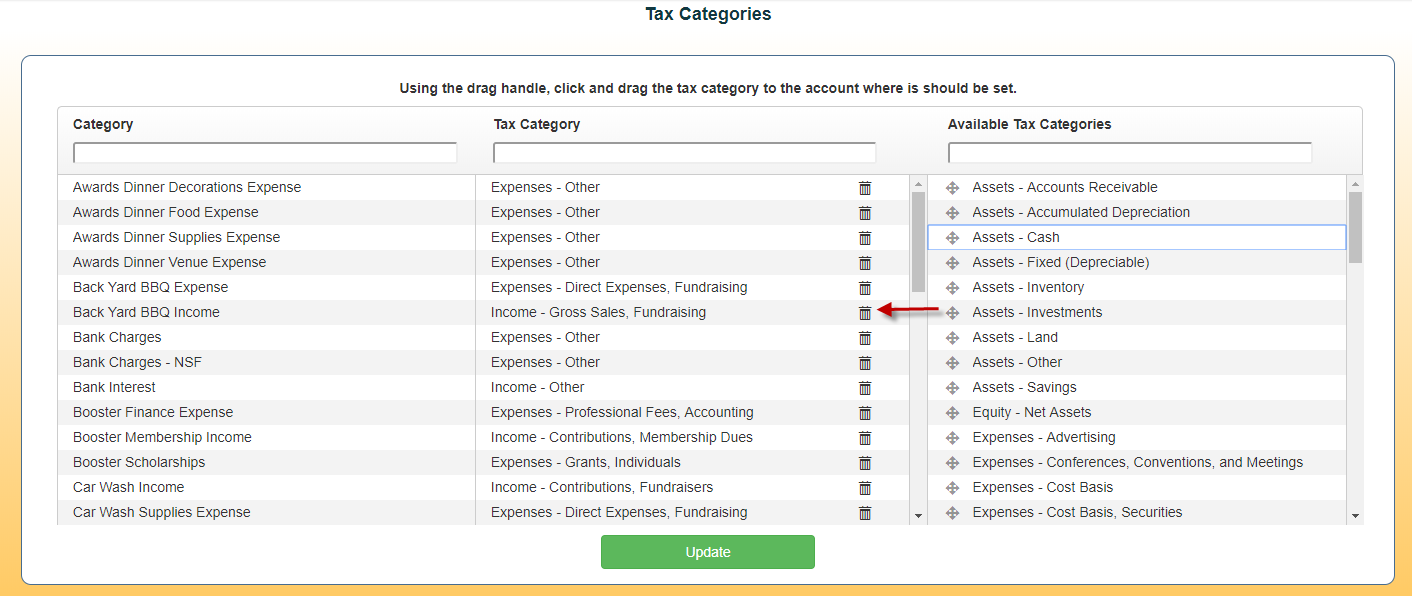

2) For all other categories, the identified category most likely does not have an assigned "Tax Category". A tax category is required in order for Booster Finance to assign it to the correct portion of the worksheet. To resolve, go to Reports/Tax Worksheets select “Tax Categories” from the pop out menu. Drag and drop the appropriate tax category from the right side of the screen to the appropriate category on the left side of the screen.

Copyright © 2010-2015 BoosterFinance™